Two headlines particularly caught my attention recently: Jack Dorsey’s Just Square Commits $100 Million to Boost Black-Owned Banks and Businesses and The Tax Rule That Inspired Billionaires and Movie Stars to Back Climate Moonshots. Both depict the growing and evolving phenomenon of Impact Investing.

The Social Investment Continuum

What options or combinations of options are available to the growing body of public, private, and nonprofit entities interested in exploring this model? To understand the possibilities, let’s start with the basic social investment continuum.

Traditional Nonprofits are structured for a public or mutual benefit other than generating profit for owners and investors. They depend on support from individuals, foundations and corporations.

Nonprofits with Income Generating Models incorporate some form of revenue generation through commercial means into their operations. They can generate not only grant support, “investors” can provide cash, sub loans and senior loans in support of the revenue generating enterprise and are able to obtain equity.

For Profit Social Ventures measure both profit and a social outcome, and can include a third measure for environment, the double or triple bottom line model. These enterprises are eligible for loan guarantees, sub loans, senior loans, and cash support in exchange for equity.

Socially Responsible Businesses are for profit businesses focused both on maximizing profits for shareholders and giving back to the wider community, often with a Private B or Benefit Corporation designation. They are eligible for cash, sub and senior loans and private equity investments.

Traditional For Profit public companies integrate environmental, social and governance (ESG) concerns into their core business and financial decisions. Investors are eligible for common stock, debt securities and preferred stock.

Tri-Sector Approach

Adoption of the Tri-Sector Approach, with the government adopting a social investment and social finance strategy, philanthropists and ultra-high net worth individuals adopting impact investing, and corporations and business owners, through green bond issuance and shareholder activism, are on the rise. This is exemplified through the concept of Catalytic Capital, defined as debt, equity, guarantees, and other investments that accept disproportionate risk and/or concessionary returns relative to a conventional investment in order to generate positive impact and enable third-party investment that otherwise would not be possible. Below are examples of projects that have received support through Catalytic Capital.

– New York City Housing Acquisition Fund: Investments from the John D. and Catherine T. MacArthur Foundation, The Rockefeller Foundation, Ford Foundation, FB Heron Foundation, Robin Hood Foundation, Starr Foundation, NYC Department of Housing Preservation and Development and a syndicate of commercial lending institutions.

– Sustainable Jobs Fund/SJF Ventures: A program-related investment (PRI) from the John D. and Catherine T. MacArthur Foundation. A PRI investment is made primarily to achieve a charitable purpose rather than to maximize financial return. This vehicle, codified by the IRS in 1969 allows foundations to make investments to further their program goals without jeopardizing their charitable status if those investments generated financial gains in the process. Other first-fund investors include Bank of America, CDFI Fund (Treasury Department), Citibank, Dakota Foundation, Deutsche Bank, First Union (now Wells Fargo), MetLife, and MBNA America Bank.

– Energy Savers: PRI’s from the John D. and Catherine T. MacArthur Foundation, Grand Victoria Foundation, Bank of America, Chicago Metropolitan Area Planning, and City of Chicago.

– Autonomyworks: PRI’s from the John D. and Catherine T. MacArthur Foundation via Arc Chicago, LLC, a special purpose fund established bond managed by MacArthur to implement the Benefit Chicago Collaboration. This innovative collaboration also includes The Chicago Community Trust, the Calvert Foundation and aims to mobilize $100 million in impact investment for nonprofit and social enterprises in Chicago.

– Blue Forest Conservation: A PRI from The Rockefeller Foundation (following a grant), and other key investments from the Moore Foundation, U.S. Forest Service, Yuba County Water Agency, National Forest Foundation, World Resources Institute, Calvert Impact Capital and CSAA Insurance Group.

– Crossboundary Energy Access: Through $5 million in mezzanine debt from The Rockefeller Foundation and investments from Ceniarth.

– Sparks Schools: Early Series A financing through Pearson Affordable Learning Fund and Series B investments through Omidyar Network.

– Microbuild Fund: A PRI from the Omidyar Network, equity from Habitat for Humanity, Triple Jump and MetLife and debt from OPIC.

The variations of catalytic capital are numerous and create exciting opportunities for nonprofits and philanthropists alike. S. Sutton & Associates Inc. stands ready to discuss your ideas and to develop a customized strategy to meet your objectives. Please contact us today for your complimentary consultation.

We were very happy to collaborate and contribute to the wonderful work of so many nonprofits, NGO’s and philanthropists this year, and wish all our clients and our Associates, who conducted exemplary work, warmest holiday wishes and success in the New Year!

With gratitude on behalf of S. Sutton & Associates Inc.,

Susan

Sourdough and Development

For his recent birthday, S. Sutton and Associates Inc. Senior Associate Randy Gorod received a sourdough starter kit from his family. He was excited, but unsure of everything this new adventure would entail. He thinks he’s finally figured it out, but while making his latest loaves he realized that making sourdough is analogous to Development.

We all know that good organizations are living organisms. They grow, change and evolve or they die. The same is for our sourdough starter. It is a living organism that needs to be cared for, fed and nurtured. The starter needs to have flour and water added, stirred and time to grow. It is like the donor who starts out with one gift per year and then starts giving more frequently and eventually makes very healthy gifts on a regular interval. Please join Randy as he explains further.

Managing a Hybrid Team

Employees’ needs are always varied. But right now, as many companies navigate returning to an office in some shape or form, team members are likely contending with vastly different situations. Some have limited or no childcare or are managing their kids’ online school; some have health issues that preclude them from returning to in-person work; and some are eager and excited to get out of the house and head back to their cubicles. How do you manage these various circumstances while treating everyone fairly? What protocols can be put in place to ensure that the employees in the office are in sync with those working from home? How do companies remain flexible given that plans may change at any moment? And how can companies help employees manage their stress levels through this transition? The Harvard Business Review provides meaningful insight that focuses on offering support, creating and setting expectations, prioritizing with flexibility in mind, emphasizing inclusion, striving for equity, watching for signs of burnout, and making it fun.

Reimagining European Philanthropy

We are facing an irreversible humanitarian and economic crisis that will permanently change our world. As societies around the world near a standstill, the COVID-19 pandemic has magnified the preexisting vulnerabilities and inequalities of our social systems. Although governments have put a sweeping range of policies and programs in place to combat the pandemic’s impact on public health and the economy, the scale of the challenge requires more.

The coronavirus crisis has mobilized an unprecedented response by the philanthropic community. The McKinsey & Company analysis shared by Senior Associate Christopher Clinton Conway identified combined commitments by European philanthropy of more than €1.1 billion by May 2020, most geared toward emergency relief to the healthcare crisis as well as general support for struggling nonprofit partners. Now, with the number of acute cases of COVID-19 going down, focus is shifting to the secondary effects of the crisis on the other programmatic areas of foundations.

Now is when we need the greatest possible support and a concerted effort by all actors in society to ensure we not only survive but emerge stronger and better from this crisis. European foundations have a unique window of opportunity to step up their actions and play an essential role in the rebuilding and recovery efforts of our countries.

Advancement of Equity, Diversity and Inclusion Practices in All Aspects of Grant Making and Grantee Relationships

Each month the network of S. Sutton Associates Inc. meets virtually to discuss topics related to the firm, their individual practices, and the ecosystem in which we are all operating as professionals. The work of the J.B and M.K Pritzker Family Foundation around the advancement of equity, diversity and inclusion practices in all aspects of grant making and grantee relationships is yet another creative and relevant example of the creativity and innovations being deployed. We are delighted to announce that Luis Roman, Program Manager for the J.B and M.K Pritzker Family Foundation, will join us during one of our upcoming Let’s Talk sessions to share the background and history of this innovative program and how the recent Black Lives Matter movement has shone a light on the impact of social, political, and economic inequality in both the US and Canada, particularly with respect to the Indigenous community, and how important relationships with grantee partners and corresponding grant making has important and far reaching ramifications.

It’s a fast-moving world and our work supporting philanthropists, nonprofit organizations and NGO’s has never been more interesting nor more relevant. My hat is off to our network of Associates who facilitate such innovation and impact.

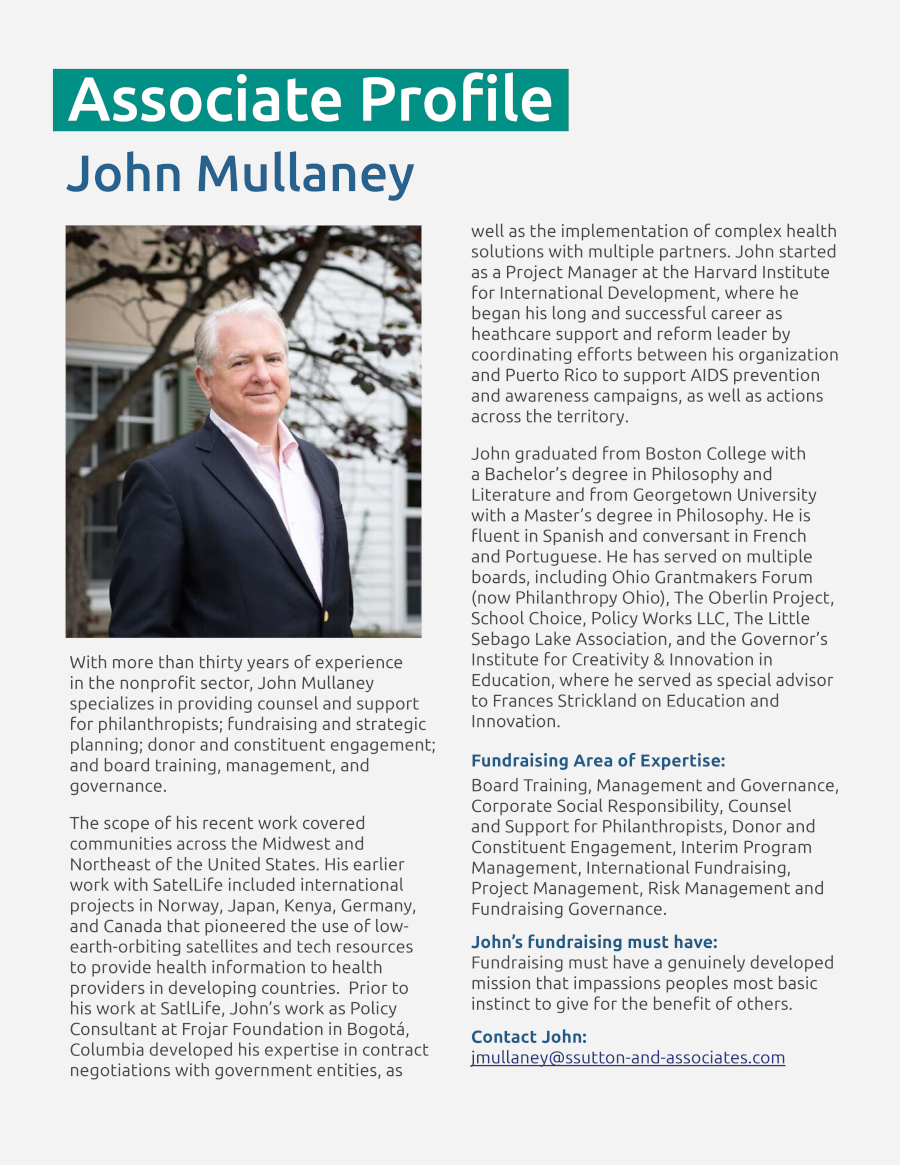

The competitive environment for philanthropic dollars increases expectations for performance and forces regular re-examination of the entire fundraising enterprise. Organizations in steady state or embarking on an expansion of fundraising efforts need to examine how well current approaches have been working. How a fundraising program has performed in the past will inform strategies in the future. S. Sutton & Associates Inc. starts by reviewing an organization’s historic results. Our consultants interview stakeholders, development team members and institutional leaders to better understand the strength and weaknesses of an organization’s fundraising program. With this information, we provide feedback on staffing, organizational structure, resource investment, program initiatives, policies, procedures, products, staff and department structure, and integration to ensure the maximum return on investment and elevated performance of an organization’s fundraising program.

Schedule your complimentary consultation to learn more about how S. Sutton & Associates Inc. can help your organization reach its fullest potential.

North America

– Facebook CEO Mark Zuckerberg and his wife, Priscilla Chan, are donating $300 million toward enhancing access to voting in the United States. The Center for Tech and Civic Life and The Center for Election & Innovation Research, organizations focused on improving the voting process, said in a statement that the donation will “promote safe and reliable voting in states and localities during the COVID-19 pandemic.”

– Billionaire Michael Bloomberg has donated $100 million to four historically Black medical schools, with each student receiving grants of up to $100,000. Bloomberg said in a Tweet that the aim of the donation is to increase the number of Black doctors in the US by “significantly reducing” the debt burden of approximately 800 medical students.

– Second Harvest Food Bank CEO Harald Herrmann owns a collection of 30 Picasso prints, but he sees a bigger picture. That’s why he’s taking the unprecedented step of auctioning off his personal collection of Picasso prints that he’s carefully collected over the last 15 years.

“We find ourselves in the throes, still in the eye of the storm of an incredible demand for food,” Herrmann said. “It just felt appropriate at this time and in this moment given the amount of food insecurity and hunger that’s not only prevalent here in Orange County but throughout the country.”

– The Boston Celtics will donate $25 million over the next decade toward initiatives focused on addressing racial injustice and social inequities in the Boston area. The donation — which will be run through their Boston Celtics Shamrock Foundation and be called “Boston Celtics United for Social Change” — will include $20 million in cash and $5 million in media assets.

“We feel both the urgency of the moment and the weight of the centuries of injustices as we undertake this critically important work,” Celtics managing partner Steve Pagliuca said in a statement. “The Boston Celtics have a proud legacy of being on the right side of racial and social justice, and we are more resolved than ever to take that commitment to another level. Our goal is to do everything we can to achieve progress on each of the targeted pillars, and we will work tirelessly to make real change.”

– Penn President Amy Gutmann and Wharton Dean Erika H. James are pleased to announce a $10 million commitment from the foundation established by Wharton MBA alumnus Yuri Milner and his wife Julia, to create the Friends of Israel MBA Fund. This new fellowship will provide full-tuition financial support to Israeli MBA students at the Wharton School of the University of Pennsylvania.

– For years, billionaire Charles Feeney had one goal in mind — to give away his massive fortune and live the rest of his life “broke.” Now, the 89-year-old has fulfilled his wish. According to Forbes’ Steven Bertoni, Feeney has finished giving more than $8 billion in anonymous donations through his foundation, Atlantic Philanthropies. Over the course of four decades, Forbes says Feeney gave $3.7 billion to education and more than $870 million to human rights and social change campaigns.

– Mastercard has announced a five-year, $500 million commitment to help close the racial wealth and opportunity gap for Black communities. The initiative will support efforts to provide African Americans and the businesses they operate with access to affordable capital, financial tools, and products and services and includes support for existing programs in Atlanta, Birmingham, Dayton, Los Angeles, New Orleans, New York City, and St. Louis.

“This is a time for action. We have an obligation as a corporate citizen to ensure the digital economy is enabled for all, an obligation to be part of the positive change Black communities so rightly need now,” said Mastercard CEO Ajay Banga. “We are starting in cities across the country with on-the-ground efforts meant to drive out inequities and create the opportunities, connections and resources that will spark economic growth for the long term.”

– Citi and the Citi Foundation announced more than $1 billion in strategic initiatives to help close the racial wealth gap and increase economic mobility in the United States. Citi’s Action for Racial Equity is a comprehensive approach to 1) providing greater access to banking and credit in communities of color, 2) increasing investment in Black-owned businesses, 3) expanding homeownership among Black Americans, and 4) advancing anti-racist practices in the financial services industry.

– Malena Mendez-Dorn, a veteran of the nonprofit world, has been named President & CEO of Big Brothers Big Sisters of Broward County, a post she will assume in January 2021. Mendez-Dorn will succeed longtime President & CEO Ana Cedeno, who will retire after 27 years of building the organization into one of the strongest Big Brothers Big Sisters agencies in the nation. She will work alongside Cedeno to facilitate a smooth transition – and tap into Cedeno’s wealth of institutional knowledge and experience.

– Brown University’s endowment has reached a record high of $4.7 billion. The Ivy League’s school officials said the welcome news is the result of a 12.1% return during the fiscal year that ended June 30. Brown’s endowment contributed $171 million last year to the university’s operating budget that includes financial aid, faculty pay and research. Overall, the endowment has contributed more than $1.6 billion to Brown’s operating budget since 2010.

– Citizens Bank announced that it has awarded 100 grants of $15,000 each totaling $1.5 million to minority-owned small businesses across its service areas as part of its previously announced $10 million investment to help drive social equity and economic advancement in underserved communities across its footprint. Through a short essay, applicants shared insight on how they would use the grant to both strengthen and sustain their business and help their community.

– The University of Pennsylvania Carey Law School is getting a $50 million gift to double the number of graduates who intend to pursue careers in serving the public interest. The gift from the Robert and Jane Toll Foundation will fund three-year scholarships for students who are committed to a public interest or government career to participate in the Toll Public Interest Scholars and Fellows Program.

“The goal is for those students to graduate with very little debt so they have the financial flexibility to take more impactful jobs, jobs which usually pay much less than private practice,” said Ted Ruger, Dean of Penn Law. “We’ll be able to double the number of those scholarships from seven to 14. It’s really important for our country right now.”

– Financial services and mobile payment company Square announced its plan to invest $100 million to address racial inequality. The company was cofounded by Twitter CEO Jack Dorsey, who serves as its CEO and chairman.

“Our support of black and minority owned financial institutions enables those institutions in turn to put funds into the hands of people in underserved communities – through loans, development projects and investments,” Square’s CFO, Amrita Ahuja told Business Insider.

– A $250-million gift will support discovery, collaboration, innovation, equity and student well-being across the University of Toronto’s Faculty of Medicine and its affiliated hospital network, advancing its leadership as a global centre of excellence in human health and health care. The transformational gift from the Temerty Foundation, established by James and Louise Temerty, will support advances in machine learning in medicine; biomedical research and collaboration across Toronto’s health-science network; innovation, commercialization and entrepreneurship; equity and accessibility in medical education; and the creation of a new state-of-the-art Faculty of Medicine building for education and research.

– Monmouth Medical Center, an RWJBarnabas Health facility, has announced the donation of a landmark $50 million gift, given by local Monmouth County philanthropists Anne and Sheldon Vogel. This transformational gift will support the development of a new medical campus in nearby Tinton Falls, extending the trusted, high-quality health care programs and services for which Monmouth Medical Center in Long Branch is known. The Vogels’ investment in Monmouth Medical Center, creating the Vogel Medical Campus, marks the largest named health care donation in New Jersey.

– One of America’s largest philanthropic organizations has announced a project to “reimagine” public monuments around the country. The Andrew W. Mellon Foundation said it would spend $250m over five years to build monuments, add context to existing ones and relocate others. The project aims to “celebrate and affirm America’s diverse histories.” It comes amid fierce public debate about monuments in the US, sparked by the Black Lives Matter movement. The charity said its pledge was the result of “years of discussion, research and intellectual exploration.”

– A $240 million commitment by the Harold Alfond Foundation to the University of Maine System is the largest gift to a public institution of higher education in New England history. The commitment of money over the next 12 years is part of a $500 million economic boost to the state by the foundation.

“Maine is receiving a transformative, unprecedented investment in its people and its future from the Harold Alfond Foundation,” said Chancellor Dannel Malloy. “And it comes at a time when we need optimism and an affirmation that we work best when we work together.”– Jane Hunt Meade, whose parents J.B. and Johnelle Hunt founded the largest publicly owned trucking company in the United States in Lowell, announced the family will donate $5 million to the library’s expansion project. The largest single donation in the Fayetteville Public Library’s history came at an opportune time, its executive director said.

“I think in Northwest Arkansas, we’ve got it really good, and I’m really glad to be a part of it,” Meade said. “We’re really proud to be a part of this wonderful space.”

– The young nobleman gazing out of the canvas may have been a member of the House of Medici, whose powerful patriarch raised taxes on the wealthy of Renaissance Florence. Now the 540-year-old painting, “Young Man Holding a Roundel,” by Sandro Botticelli, is saving millions in taxes for a 21st Century billionaire. The painting was acquired almost 40 years ago for just over $1 million by Sheldon Solow, the New York real estate tycoon, who plans to sell it for more than US$80 million in January at Sotheby’s. Normally, the windfall would result in at least a US$33 million capital gains tax bill. But because Solow routed the Young Man through his private foundation, he’ll owe a fraction of that amount –– and has already saved millions on his personal income taxes over decades.

– The Rideau Hall Foundation will begin exciting new work this Fall thanks to the incredible generosity of the Barrett Family Foundation. Their gift of $10 million will provide the seed funding for the Barrett Canada Fund. Through this new fund, we will escalate our work in civic and charitable engagement, Canadian innovation, and Indigenous education: supporting projects that will contribute to a more equitable, kinder and smarter Canada.

– The Ford Foundation announced it has doubled its funding support for U.S.-based racial justice and civil rights groups with at least $180 million in new funding from the proceeds of the unprecedented sale of $1 billion in social bonds. The new funding significantly boosts Ford’s ongoing commitment to advancing racial equity at a critical time when America is in an historic and long-needed reckoning over racism and injustice. In order to bolster a decades-long commitment to racial justice efforts across the country, the Ford Foundation will direct new funds to groups creating structural and systemic change through strategic litigation, policy advocacy and grassroots organizing. Currently, only 5 percent of racial equity funding in the U.S. is specifically focused on movement-building and grassroots organizing, indicating an urgent need to increase funding for activists and groups that are advancing sweeping change.

– During the height of lockdown in April, the Association of Art Museum Directors (AAMD)—a leading professional organization that represents museums across North America—loosened its guidelines on how members could use the proceeds of art sold from their collections. Now, a number of institutions are coming out of the woodwork to take advantage of the relaxed rules—including a high-profile sell-off at the Baltimore Museum of Art that represents the most liberal interpretation of the new policy yet. the Baltimore Museum announced it would sell three works from its collection through Sotheby’s for an estimated $65 million. And while the traditional AAMD guidelines stated that proceeds from art sales could only be reinvested back into art acquisitions, the loosened rules allow for the funds to be used for “direct care of the collection.”

Europe

– British broadcaster David Attenborough led a campaign by conservation groups for the world to invest $500 billion a year to halt the destruction of nature, saying the future of the planet was in “grave jeopardy.” Attenborough, whose new film “A Life on Our Planet” documents the dangers posed by climate change and the extinction of species, made his statement as the United Nations convened a one-day summit aimed at galvanizing action to protect wildlife.

“Our natural world is under greater pressure now than at any time in human history, and the future of the entire planet – on which every single one of us depends – is in grave jeopardy,” Attenborough, 94, said in a news release.

– After five years of sustained pressure that saw students protest and graffiti on ancient buildings, Cambridge University has committed to divesting its endowment from fossil fuels in a more comprehensive way than its peers have done so far. The 800-year-old university said that it will divest direct and indirect holdings in fossil fuels from its 3.5 billion pound ($4.5 billion) fund by 2030 and pledged to make “significant” investments in renewable energy by 2025. It also promised to ensure greenhouse-gas emissions from the activities of all its investments balance out to zero by 2038. The institution last year committed to reaching neutrality on its own energy-related emissions by 2048.

– An English philanthropist has stepped in to help the UK’s beleaguered arts sector with her own £2.5 million ($3.2 million) rescue package aimed at restarting cultural organizations’ education programming. Dame Vivien Duffield made the announcement at London’s Royal Academy. She is making the generous donation through her charitable foundation, the Clore Duffield Foundation, which has provided organizations with some £30 million ($38 million) over the past two decades to establish education and outreach centers called Clore Learning Spaces at their institutions. The cash infusion will support education and community work in the social-distancing era.

– London’s Royal Opera House sold a prized David Hockey portrait to raise cash to get through the COVID-19 pandemic, the worst crisis in its history. Hockney’s Portrait of David Webster brought in 12.8 million GBP ($16.9 million) at the Christie’s London contemporary auction. “As we face the biggest crisis in our history, the sale of David Hockney’s wonderful portrait of Sir David Webster is a vital part of our strategy for recovery,” said Alex Beard, chief executive of the Royal Opera House, in a statement.

South Asia

– The Bill & Melinda Gates Foundation will provide $150 million to Gavi, which will be directed to the Serum Institute of India (SII) to fund the additional 10 crore COVID-19 vaccine doses for low and middle-income countries.

The fund transfer will be conducted through the Foundation’s Strategic Investment Fund and will take the total funding provided by this collaboration to $300 million.

Contact@SSutton-and-Associates.com

Contact@SSutton-and-Associates.com 420-737-921-492

420-737-921-492 410-245-0398

410-245-0398 647-969-8866

647-969-8866

www.SSutton-and-Associates.com

www.SSutton-and-Associates.com